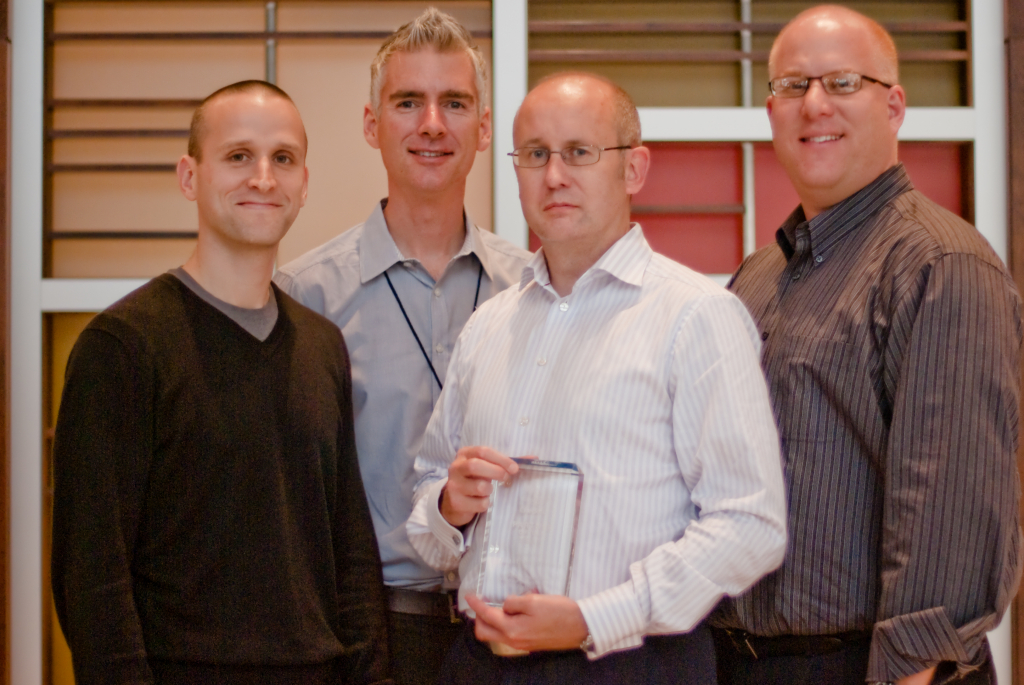

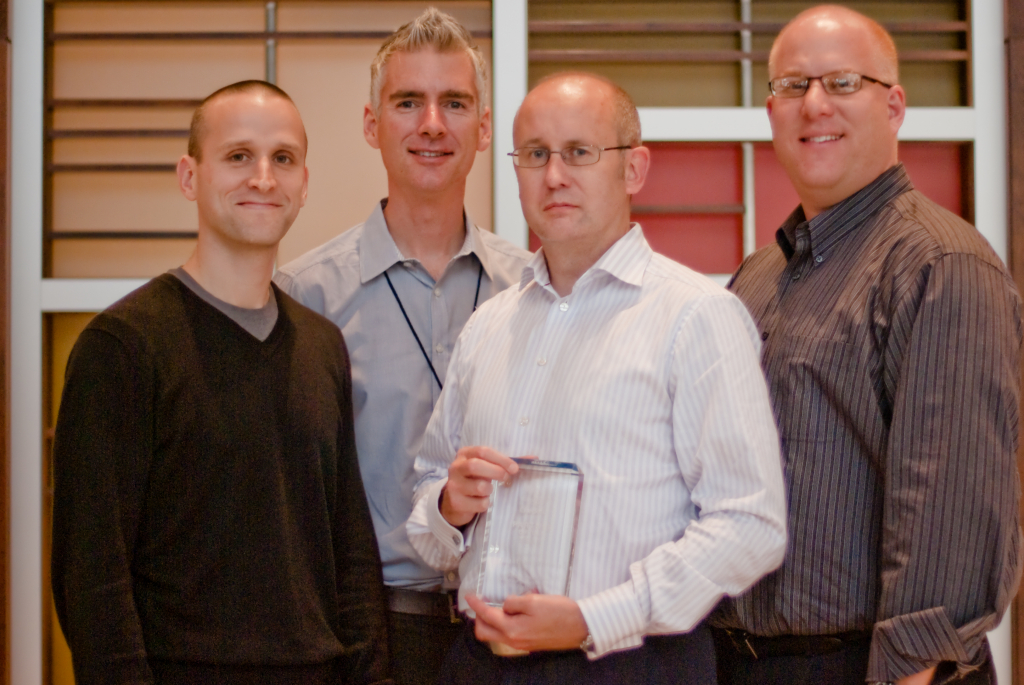

[Receiving a partner award from AccountEdge back in 2010, Morristown, New Jersey]

AccountEdge (formerly MYOB) was an amazing product that was streets ahead of the competition in its day. And, it was one of few accounting products that worked on the Mac as well as Windows.

It would be fair to say I built my accounting firm around it, serving clients using AccountEdge and training any number of new users as well as using it for my own business.

Unsurprisingly, AccountEdge lost a lot of ground when Mamut, the UK distributor, decided to discontinue the Windows version. On the plus side, they agreed to continue with the Mac product, which just got better and better over the years due to the great work done by the US owners of AccountEdge, Acclivity LLC.

Whilst AccountEdge is, and probably always will be, a desktop on-premise product, it has a couple of excellent ‘companion’ apps in AccountEdge Cloud and AccountEdge Mobile. They allow certain features to be used online or on mobile (copy of the desktop product required).

It would be ridiculous to try and argue that the emergence and incredible growth of online (cloud) accounting products has not been a complete game-changer for the small business accounting software market. Xero, for example, has morphed from being a laughable joke where basic features that had been in AccountEdge/MYOB for literally decades were announced with huge fanfare, to being a kind of worldwide movement - if there is such a thing in accounting software!

Inevitably, AccountEdge’s place in the accounting landscape has changed. It’s gone from being the go-to solution for small businesses using the Mac to a niche product that only serves some elements of that market.

The situation wasn’t helped when it turned out that AccountEdge couldn’t be adapted to work on the latest iterations of the Mac operating system. Converting the great code that gave AccountEdge/MYOB its unique features back in the 1990s and 20s to 64-bit provided impossible, and the product is stuck on MacOS 10.14 Mojave. There are workarounds available such as using emulators Parallels to run a virtual Mojave Mac on a more up to date machine.

Far better and hopefully just around the corner for the UK, we have the ‘CrossOver’ solution. CrossOver is a Windows compatibility layer that allows you to run a Windows application without a virtual machine or a full version of Windows. To be clear, it is the Windows version running on Mac, and understandably, that’s not going to work for everyone.

Acclivity, the AccountEdge developers, have created a very slick installer. When running AccountEdge for the first time, after dragging it into the Applications folder, it installs and sets up CrossOver, creates the AccountEdge folder in the User directory and migrates the Mac forms (customised invoice templates etc.,) to Windows.

When running, it looks like (and indeed is) the Windows version, although there are some visual differences. There is currently no multiuser version.

Personally, I’m looking for a bit of a Renaissance with AccountEdge, getting back to serving more users with accounting and training etc.

Given its new status as a niche status, which sub-categories of Mac users will AccountEdge work best for? Here's my list:

- anyone who doesn’t need/want to use cloud software

- anyone with a poor internet connection

- anyone who wants to use the advanced features found in AccountEdge that are only available to cloud accounting as expensive add-ons. Examples include:

- bill of materials and product auto-build (from components)

- time recording & billing

- any Shopify users who want the tight integration to accounting that AccountEdge offers